UBI: Past, Present and Future

📖 Definition

What is Universal Basic Income?

Universal Basic Income (UBI) is an unconditional cash payment made to all citizens of a country or region, regardless of their employment status, wealth, or other circumstances. It represents a fundamental shift from conditional welfare to universal economic security.

Core Principles of UBI

The goals of a basic income system are multifaceted: alleviating poverty, reducing bureaucratic overhead, providing economic security in an age of automation, and enabling greater individual freedom and choice. Unlike traditional welfare systems that require means-testing and behavioral conditions, UBI provides a foundation of economic security that allows people to take risks, pursue education, care for family members, or engage in creative endeavors.

UBI vs Traditional Welfare

| Aspect | Traditional Welfare | Universal Basic Income |

|---|---|---|

| Eligibility | Means-tested, conditional | Universal, unconditional |

| Administrative Cost | High (15-20% of budget) | Low (2-5% of budget) |

| Stigma | High social stigma | No stigma (universal) |

| Work Incentives | Often creates welfare traps | Maintains work incentives |

| Coverage | Gaps in coverage | Complete coverage |

🏛️ History of UBI

The idea of providing a basic income to all members of society goes back centuries. The 16th-century English philosopher and statesman Thomas More mentions the idea in his best-known work, "Utopia" (1516), where he proposed that society should provide for all its members' basic needs.

Thomas Paine, a pamphleteer whose ideas helped spur the American Revolution, proposed a tax plan in "Agrarian Justice" (1797) in which revenues would provide a basic government income to all citizens as compensation for the loss of their natural inheritance through land ownership.

Martin Luther King Jr. proposed "guaranteed income" in his book "Where Do We Go from Here: Chaos or Community?" published in 1967, arguing that it would be more efficient than welfare programs and would preserve human dignity.

Early Implementations and Experiments

The modern concept gained traction in the 20th century with several groundbreaking experiments:

📊 Major UBI Experiments Timeline

- Alaska Permanent Fund (1976): The longest-running UBI-like program, distributing oil revenue dividends to all residents. In 2022, each eligible Alaskan received $1,606, with total distributions exceeding $2.1 billion annually.

- Negative Income Tax Experiments (1960s-1970s): The U.S. conducted four major pilot programs in New Jersey, Pennsylvania, Iowa, North Carolina, Seattle, and Denver, involving over 8,500 families and costing $225 million (inflation-adjusted).

- Finland's Basic Income Experiment (2017-2018): Provided €560 monthly to 2,000 unemployed individuals, showing 6% increase in employment and significant mental health improvements.

- Kenya's GiveDirectly Program: The world's largest UBI experiment, providing $22 monthly to over 20,000 people across 295 villages, with a 12-year commitment totaling $30 million.

UBI as Government Investment in Individuals

Many existing social programs can be viewed as precursors to UBI:

- Maternity Benefits: Universal support during childbirth and early childcare

- Public Education: Free access to basic education for all children

- Free College Education: Some countries provide tuition-free higher education

- Targeted Transportation Subsidies: Free or subsidized public transport for specific groups

- Unemployment Benefits: Temporary financial support for job seekers

- Universal Healthcare: Free or subsidized medical care for all citizens

- Pension Systems: Guaranteed income for elderly citizens

❌ Arguments Against UBI

Critics of UBI raise several significant concerns backed by economic theory and empirical evidence:

💰 Cost Analysis: UBI in the United States

Economic Arguments

- Inflation Risk: Injecting $3.8 trillion annually into the US economy could drive inflation. Historical data shows that rapid money supply increases correlate with price level increases, potentially eroding UBI's purchasing power.

- Fiscal Burden: A $1,000 monthly UBI would cost 76% of the current federal budget ($5 trillion), requiring unprecedented tax increases or deficit spending.

- Work Disincentives: Economic theory suggests guaranteed income reduces labor supply. The 1970s NIT experiments showed 1-5% reduction in work hours, though critics argue modern UBI could have larger effects.

- Crowding Out Private Investment: Funding UBI through corporate taxes (estimated 35-50% rates needed) could reduce business investment, R&D spending, and economic growth.

Social and Political Arguments

- Dependency Culture: UBI might create long-term dependence on government support rather than encouraging self-reliance

- Political Manipulation: Politicians could use UBI as a tool to buy votes or maintain power

- Targeting Inefficiency: Universal programs may waste resources on those who don't need support

- Social Cohesion: Removing the connection between contribution and reward might undermine social solidarity

🔬 Current Research on UBI

Contemporary research on UBI spans multiple disciplines and geographies, with over $100 million invested in studies worldwide since 2016:

🌍 Global UBI Research Investment (2016-2024)

Major Ongoing Studies

| Study | Location | Participants | Amount | Duration | Key Findings |

|---|---|---|---|---|---|

| Stockton SEED | California, USA | 125 | $500/month | 18 months | 28% increase in full-time employment |

| GiveDirectly | Kenya | 20,000+ | $22/month | 12 years | 2.6x economic multiplier effect |

| B-MINCOME | Barcelona, Spain | 1,000 | €1,676/month | 2 years | 21% reduction in poverty |

| Pilotprojekt | Germany | 122 | €1,200/month | 3 years | Ongoing (started 2021) |

| OpenResearch | Texas & Illinois, USA | 3,000 | $1,000/month | 3 years | Ongoing (started 2022) |

Key Research Findings

- Work Behavior: Meta-analysis of 16 studies shows average 2% reduction in work hours, with increases in job quality and entrepreneurship. Stockton study showed 28% increase in full-time employment.

- Health Outcomes: Consistent 15-25% improvements in mental health metrics, 30% reduction in stress-related hospital visits, and improved birth outcomes in pregnant recipients.

- Education: Children in UBI households show 12% improvement in school attendance, 8% increase in test scores, and 40% reduction in child labor in developing countries.

- Economic Activity: Local economies see 2.6x multiplier effect (Kenya), with 78% of UBI spent on basic necessities, stimulating local businesses.

- Administrative Efficiency: UBI programs cost 2-5% to administer vs 15-20% for traditional welfare, saving billions in bureaucratic overhead.

⚠️ Failures of UBI

Several UBI experiments have faced challenges or failed to meet expectations:

Implementation Challenges

- Finland's Experiment Limitations: Limited scope (only unemployed) and short duration prevented comprehensive assessment

- Political Resistance: Many pilot programs face political opposition and funding cuts

- Scale Problems: Small-scale pilots may not capture macroeconomic effects of full implementation

- Design Flaws: Some experiments lack proper control groups or have confounding variables

Unintended Consequences

- Market Distortions: In some cases, landlords raised rents knowing tenants had guaranteed income

- Substitution Effects: UBI sometimes replaced other beneficial programs without equivalent value

- Cultural Resistance: Some communities rejected UBI due to cultural values around work and self-reliance

💰 UBI is Not Money, Wellbeing, or Redistributed GDP

A critical misconception about UBI is that it's simply about money distribution. UBI represents a fundamental shift in how society organizes social status around economic relationships:

Beyond Monetary Transfer

- Freedom and Agency: UBI provides the foundation for genuine choice in life paths, not just financial security

- Power Redistribution: It shifts bargaining power from employers to workers, enabling people to refuse exploitative conditions

- Innovation Catalyst: By providing security, UBI enables risk-taking, creativity, and entrepreneurship

- Social Infrastructure: UBI creates a platform for human development beyond mere survival

Wellbeing vs. Income

UBI's impact on wellbeing extends far beyond the cash amount:

- Reduced Anxiety: Security of income reduces stress-related health problems

- Improved Relationships: Financial stress is a major cause of family breakdown

- Community Engagement: People with basic security can contribute to community activities

- Personal Development: Time and mental space for education, skills development, and self-improvement

🏛️ Centralized UBI

Government-administered UBI represents the most commonly discussed model:

Advantages of Centralized Systems

- Scale and Efficiency: Governments can implement UBI at population scale with existing infrastructure

- Democratic Accountability: Elected officials are accountable for program design and implementation

- Redistribution Capability: Governments can tax high earners to fund UBI for all citizens

- Legal Framework: Established legal systems can protect UBI as a right

Risks of Centralized UBI

- Political Vulnerability: Programs can be cut or modified by changing governments

- Bureaucratic Inefficiency: Government administration may be slow and costly

- Control and Surveillance: Centralized systems enable monitoring and control of recipients

- One-Size-Fits-All: National programs may not address local needs and conditions

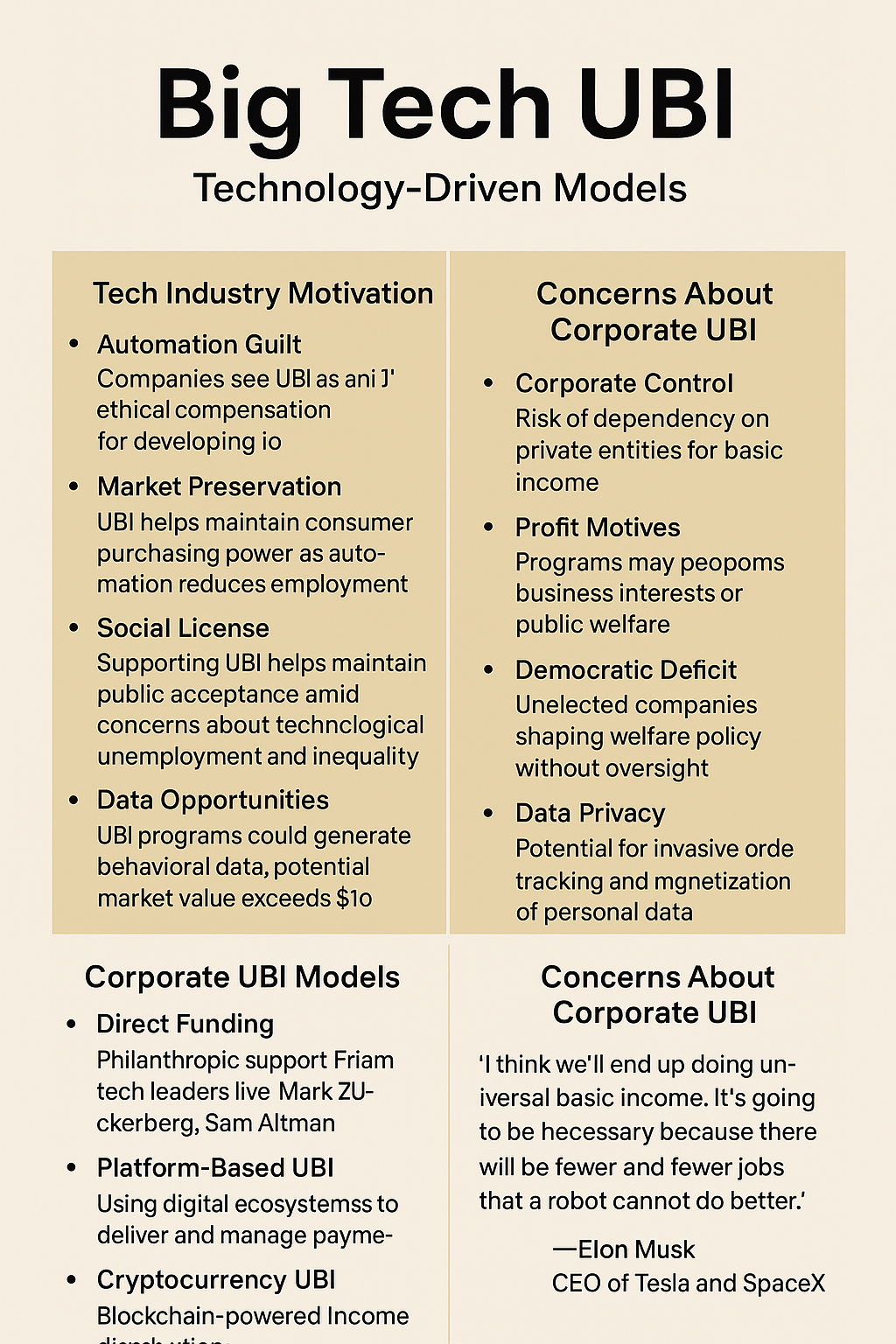

🏢 Big Tech UBI

Technology companies have increasingly discussed UBI as automation displaces workers, with major tech leaders investing millions in research:

💼 Tech Industry UBI Investments

Tech Industry Motivation

- Automation Guilt: Companies developing job-displacing technology see UBI as moral compensation. OpenAI allocated $50M for UBI research, while Google's parent Alphabet has invested $25M in related studies.

- Market Preservation: UBI maintains consumer purchasing power as automation reduces employment. McKinsey estimates AI could displace 375 million workers globally by 2030.

- Social License: Supporting UBI helps tech companies maintain public acceptance amid growing concerns about technological unemployment and inequality.

- Data Opportunities: UBI programs could generate valuable behavioral data, with potential market value exceeding $100 billion annually.

Corporate UBI Models

- Direct Funding: Companies like Facebook's Mark Zuckerberg funding UBI research

- Platform-Based UBI: Using digital platforms to distribute and manage basic income

- Cryptocurrency UBI: Blockchain-based universal income systems

- Corporate Taxation: Automation taxes on companies to fund UBI

Concerns About Corporate UBI

- Corporate Control: Private companies controlling basic income could create new forms of dependency

- Profit Motives: Corporate UBI might serve business interests rather than public welfare

- Democratic Deficit: Unelected corporations making decisions about public welfare

- Data Privacy: Corporate UBI systems could enable unprecedented surveillance

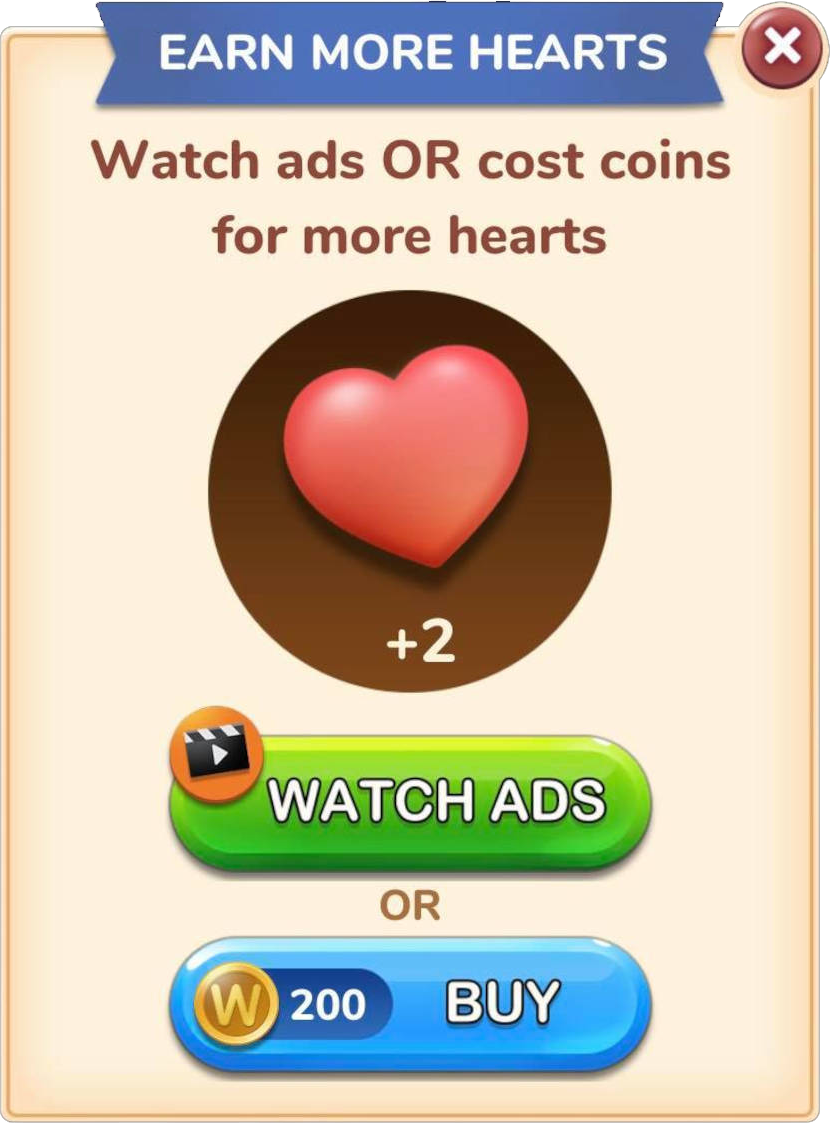

🔄 Freemium UBI Economy

The Freemium UBI model combines universal basic support with optional premium services, creating a hybrid system that ensures basic needs while enabling market dynamics for additional benefits.

Freemium UBI mechanism

- Basic Layer: Universal guaranteed free services covering essential needs = Free to Play

- Premium Layer: Optional paid services and enhanced benefits = Play to win

- Market Integration: Competitive marketplace for premium services

- Choice Architecture: Freedom to upgrade or remain at basic level

Examples of Freemium UBI

- Gaming: Basic free to play with rewarded adertisement coverage with premium play to win options

- Email: Free basic gmail with premium storage resources

- Entertainment: Basic ad revenue generating with interrupted videos in YouTube

- Transportation: Free delivery on discount and higher baskets with premium mobility services in Amazon

- Social Media: Free access to post with no content blocking

- AI: Free chatgpt and free openrouter API leads to freemium consumption of AI

Advantages and Challenges

Advantages:

- Ensures universal basic security while preserving market incentives

- Creates sustainable funding through premium service revenues - local efficient taxation

- Maintains individual choice and autonomy - no top down pressure

- Drives innovation in service delivery- majority free users dial down paid goodharts law

Challenges:

- Preventing quality gaps between basic and premium services

- Managing transition between service tiers

- Ensuring basic tier remains truly sufficient

- Avoiding stigmatization of basic service users

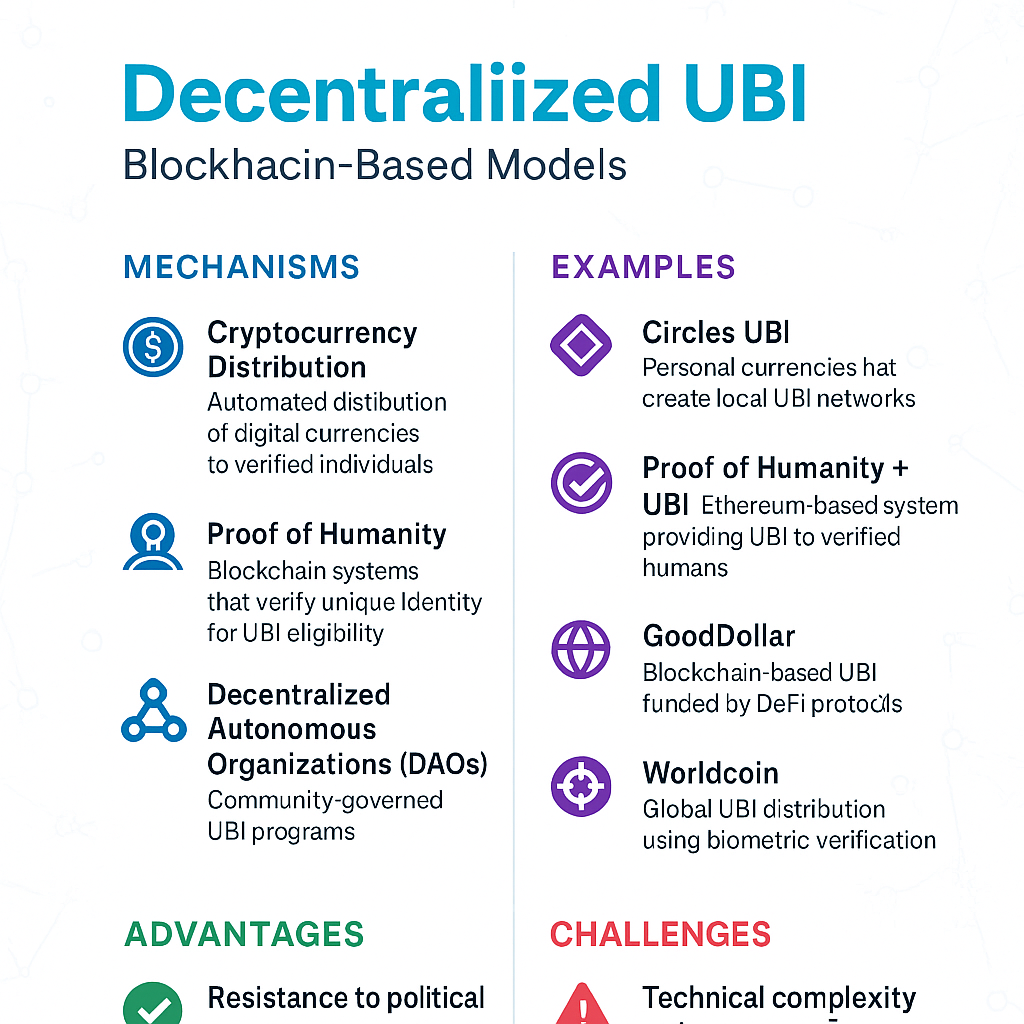

🌐 Decentralized UBI

Blockchain and cryptocurrency technologies enable new models of UBI distribution:

Decentralized UBI Mechanisms

- Cryptocurrency Distribution: Automated distribution of digital currencies to verified individuals

- Proof of Humanity: Blockchain systems that verify unique human identity for UBI eligibility

- Decentralized Autonomous Organizations (DAOs): Community-governed UBI programs

- Smart Contracts: Automated UBI distribution based on predetermined conditions

Examples of Decentralized UBI

- Circles UBI: Personal currencies that create local UBI networks

- Proof of Humanity + UBI: Ethereum-based system providing UBI to verified humans

- GoodDollar: Blockchain-based UBI funded by DeFi protocols

- Worldcoin: Global UBI distribution using biometric verification

Advantages and Challenges

Advantages:

- Resistance to political interference

- Global accessibility

- Transparent and auditable

- Lower administrative costs

Challenges:

- Technical complexity and user adoption

- Identity verification at scale

- Regulatory uncertainty

- Environmental concerns (energy consumption)

🏴 Anarchist UBI

Anarchist perspectives on UBI focus on mutual aid and voluntary cooperation rather than state or corporate systems:

Anarchist Critique of Traditional UBI

- State Dependency: Government UBI reinforces state power and citizen dependency

- Capitalist Preservation: UBI might preserve capitalism by making it more tolerable

- Hierarchical Control: Centralized UBI maintains existing power structures

- Reformist Trap: UBI might prevent more radical economic transformation

Anarchist Alternatives

- Mutual Aid Networks: Community-based support systems without state involvement

- Gift Economy: Economic systems based on giving rather than exchange

- Commons-Based Production: Shared ownership and management of productive resources

- Voluntary Association: Free association of individuals for mutual benefit

Anarchist UBI Models

- Community Currencies: Local exchange systems that bypass state and corporate control

- Cooperative Networks: Federated cooperatives providing mutual support

- Resource Sharing: Community ownership of essential resources

- Skill Sharing: Networks for exchanging services and knowledge

🎯 Status Games vs UBI

Human status competition presents both challenges and opportunities for UBI implementation:

Status Competition Challenges

- Relative Status: People care about relative position, not just absolute income

- Work as Identity: Jobs provide social status and identity beyond income

- Signaling Value: Earned income signals competence and social value

- Zero-Sum Thinking: Status games create resistance to universal benefits

UBI's Impact on Status Systems

- Decoupling Survival from Status: UBI separates basic needs from status competition

- New Status Metrics: Could shift status from wealth accumulation to contribution and creativity

- Reduced Status Anxiety: Basic security might reduce destructive status competition

- Authentic Pursuits: People could pursue meaningful work rather than status-driven careers

Designing UBI for Status Considerations

- Universal Application: Everyone receiving UBI reduces stigma and status differentiation

- Supplementary Income: UBI as a foundation rather than replacement for earned income

- Recognition Systems: Alternative ways to acknowledge contribution and achievement

- Community Engagement: Opportunities for status through community service and leadership

🎯 Try our AI doctor App - DrJaicSam.xyz

Invest in your health today and save thousands on medical costs tomorrow

Weekly Plan

- All Premium Features

- Weekly Health Reports

- Flexible Commitment

- Cancel Anytime

Monthly Plan

- All Premium Features

- Monthly Health Analytics

- Priority Support

- Best Value Option

Annual Plan

- All Premium Features

- Annual Health Summary

- Maximum Savings

- 2 Months Free

🤖 AGI vs UBI

Artificial General Intelligence (AGI) development creates both urgency and complexity for UBI discussions, with leading AI researchers predicting transformative impacts within decades:

🤖 AGI Timeline and Impact Predictions

AGI as UBI Driver

- Mass Unemployment: AGI could automate 80% of current jobs within 15 years, creating unprecedented unemployment. Goldman Sachs estimates 300 million jobs globally at immediate risk.

- Wealth Concentration: AGI ownership concentrated among tech giants could create extreme inequality. The top 1% might control 99% of AGI-generated wealth without redistribution mechanisms.

- Transition Period: UBI could ease the 10-15 year transition to an AGI-dominated economy, preventing social collapse during the adjustment period.

- Human Dignity: UBI preserves human agency and purpose in an age where human labor becomes economically obsolete, maintaining social cohesion and individual worth.

AGI-Enabled UBI

- Abundance Creation: AGI could generate enough wealth to fund generous UBI

- Administrative Efficiency: AI systems could manage UBI distribution with minimal human oversight

- Personalized UBI: AI could customize UBI amounts based on individual needs and circumstances

- Dynamic Adjustment: Real-time economic monitoring and UBI adjustment

Risks and Considerations

- Control Concentration: Those controlling AGI might control UBI distribution

- Human Obsolescence: UBI might be temporary if humans become economically irrelevant

- Dependency Risk: Complete dependence on AGI-generated wealth

- Value Alignment: Ensuring AGI systems serve human welfare rather than narrow interests

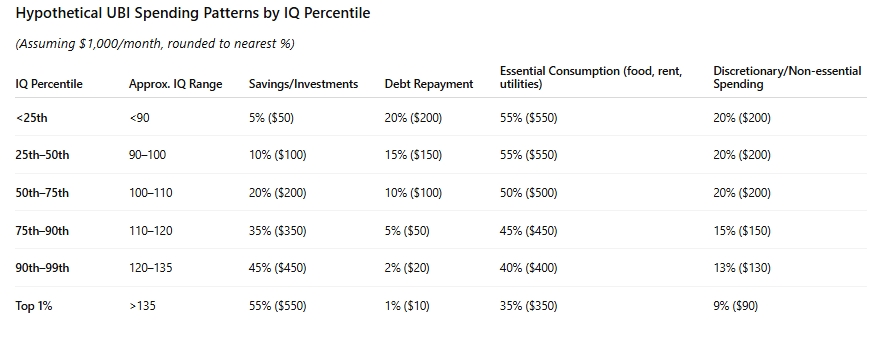

🧠 IQ vs UBI

IQ Impact on Financial Decision-Making

Research shows significant correlations between cognitive ability and financial outcomes, with implications for how UBI benefits are utilized across different IQ groups.

IQ Groups and UBI Usage Patterns

Key Considerations

| IQ Level | Typical UBI Usage | Long-term Impact |

|---|---|---|

| 115+ | Investment, Education, Business | Wealth Accumulation |

| 85-115 | Mixed Saving/Spending | Moderate Growth |

| Below 85 | Immediate Needs | Limited Growth |

Policy Recommendations

- Automated Savings: Default 10-20% UBI allocation to investment accounts

- Financial Education: Mandatory financial literacy programs

- Smart Defaults: Pre-structured investment options

- Digital Tools: AI-powered financial management assistance

- Targeted Support: Individualized financial planning and support

- Crypto Blockchain: Secure and transparent financial transactions

- Reversible Transactions: Ability to withdraw UBI when needed and refund on purchasing for basic necessities

Bridging the Gap

While cognitive differences influence UBI utilization, targeted support systems can help ensure more equitable outcomes across all IQ levels. The key is implementing automatic mechanisms and educational support that work regardless of cognitive ability.

👥 UBI vs Polygyny

The relationship between economic systems and mating patterns presents an unconventional but important perspective on UBI:

Economic Inequality and Mating Markets

- Wealth Concentration: Extreme inequality should lead to polygynous mating patterns where wealthy men redistribute his wealth to multiple partners and their family effectively lowering wealth inequality.

- Male Competition: Economic desperation intensifies male competition for resources and mates especially social status.

- Male immigration: Social Status deprivation leads to illegal immigration of men to boast their status and lead to more rape to sexual assault of western or urban females across the world.

- Social Stability: Societies with many unmarried, economically marginalized men face instability - become terminally online or terrorists. They need to be properly dealt with higher incarceration

- Genetic Superiority: Economic inequality translates into reproductive inequality and win for genetically superior men (good looking and high IQ)

UBI's Potential Impact

- Reduced Desperation: Basic income security might reduce destructive male competition to get addicted to AI generated porn

- Relationship Quality: Financial security could improve relationship stability and quality with other men

- Gender Equality: UBI reduces economic dependence of females to weak males in relationships

- Social Cohesion: More equitable resource distribution through polygyny could reduce social tensions

Evolutionary Psychology Considerations

- Status Signaling: UBI might change how individuals signal mate value

- Parental Investment: Economic security could improve child-rearing conditions

- Cooperation vs Competition: UBI might shift social dynamics from competition to cooperation thanks to less desire for money

- Long-term Thinking: Security enables longer-term relationship and family planning in minds of both sexes.

📖 UBI vs pension

Pension is the default UBI given to all citizens on completion of certain jobs in public sector, while the private sector wants you to submit money into the providence fund until .

CURRENT SPENDING ON PENSION AND ASSOCIATED WELFARE

Global Pension Expenditure

Global pension spending is a significant component of global welfare spending, accounting for $11.3 trillion in 2023. This includes contributions from individuals, families, and organizations to provide financial security to those who are unable to work or have difficulty finding work.

- Individuals: $7.2 trillion

- Families: $2.1 trillion

- Organizations: $1.2 trillion

- Private-sector Pension Funds: $1.2 trillion

- Public-sector Pension Funds: $1.1 trillion

- Other Organizations: $1.1 trillion

Global pension age

Global pension age is the age at which individuals start receiving pension contributions. In the U.S., the average global pension age is 65 years old, while in other countries, it ranges from 60 to 70 years old.

| Nation | Pension Age | Life Expectancy | Expected Years of Pension |

|---|---|---|---|

| U.S. | 67 | 76.1 | 9.1 |

| China | 63 | 77.3 | 14.3 |

| India | 60 | 70.82 | 10.82 |

| Canada | 65 | 82.3 | 17.3 |

| United Kingdom | 65 | 81.3 | 15.3 |

| Germany | 67 | 81.1 | 14.1 |

| Russia | 65 | 73.5 | 8.5 |

| France | 64 | 82.5 | 17.5 |

| Japan | 65 | 84.7 | 19.7 |

| South Korea | 65 | 83.5 | 18.5 |

| Australia | 67 | 83.1 | 16.1 |

| New Zealand | 65 | 82.3 | 17.3 |

| Sweden | 65 | 82.1 | 17.1 |

| Denmark | 67 | 82.0 | 15.0 |

| Finland | 65 | 81.8 | 16.8 |

| Norway | 65 | 81.7 | 16.7 |

| Switzerland | 65 | 81.6 | 16.6 |

| Italy | 65 | 81.5 | 16.5 |

| Spain | 65 | 81.4 | 16.4 |

| Saudi Arabia | 52 | 81.4 | 29.4 |

| Libya | 70 | 81.4 | 11.4 |

Global Healthcare Expenditure

Global healthcare expenditure is a critical component of global welfare spending, accounting for $8.8 trillion in 2023. This includes contributions from individuals, families, and organizations to provide medical care and other healthcare services.

Government Healthcare Programs Expenditure

Government-funded healthcare programs represent a significant portion of national healthcare spending, with programs like Medicare and Medicaid in the U.S. providing essential coverage to millions. The U.S. spends approximately $1.5 trillion on Medicare and $734 billion on Medicaid annually, while other countries have their own universal healthcare systems.

- Medicare (U.S.): $1.5 trillion serving 65+ million beneficiaries

- Medicaid (U.S.): $734 billion covering 80+ million Americans

- Universal Healthcare Systems: $3.8 trillion across EU, UK, Canada, and other nations

- China Healthcare: $1.1 trillion covering 1.4+ billion citizens through public insurance

- India Ayushman Bharat: $12.6 billion serving 500+ million beneficiaries

- Japan National Health Insurance: $485 billion covering 126+ million residents

- South Korea NHI: $77 billion providing universal coverage to 51+ million people

- Taiwan NHI: $47 billion serving 23+ million citizens with comprehensive care

- United Kingdom National Health Service: $270 billion covering 67+ million people

- Canada Health Insurance: $308 billion covering 38+ million people

- Australia Health Insurance: $195 billion covering 26+ million people

- Germany National Health Service: $485 billion covering 83+ million people

- France National Health Service: $325 billion covering 67+ million people

- Italy National Health Service: $171 billion covering 60+ million people

- Spain National Health Service: $119 billion covering 47+ million people

- Sweden National Health Service: $63 billion covering 10+ million people

- Netherlands National Health Service: $92 billion covering 17+ million people

- Norway National Health Service: $47 billion covering 5+ million people

- Switzerland National Health Service: $85 billion covering 8+ million people

- Finland National Health Service: $23 billion covering 5+ million people

- Denmark National Health Service: $45 billion covering 6+ million people

- Poland National Health Service: $104 billion covering 38+ million people

- Bulgaria National Health Service: $9 billion covering 7+ million people

- Romania National Health Service: $15 billion covering 19+ million people

📊 Global Pension Age Reduction Impact

📊 Workforce vs Automation Trends (2020-2050)

Projected changes in workforce composition and retirement demographics

Why we should expand pension base instead of giving handouts to everyone everywhere all at once?

Expanding the pension base is a more gradual and sustainable approach. It allows for better control over the distribution process, reduces the risk of mass exodus, and provides more flexibility in adjusting to changing circumstances. Controls “Gerontocracy.” A pension system rewards lifetime contributors—and can be designed so that benefits phase out or taper at very advanced ages—allowing the “political voice” (through taxes and contributions) to reflect demographic realities. Handouts dilute political accountability. When everyone receives the same check, powerful voting blocs (e.g. large elderly cohorts) can lobby to raise the universal level at the expense of higher-cost burdens on working-age taxpayers. Targeted vs. Blanket Transfers. Expanding pensions channels wealth from today’s workers to today’s retirees in a transparent, actuarial way. You know exactly who pays in and who draws out. UBI-style grants blur the lines. It’s hard to tell which generation or income group is net-positive; hidden cross-subsidies can exacerbate inequality rather than reduce it.

- It reduces crime by preventing mass youth unemployment and provided more stable employment for children and young adults.

- It increases familial cohabitation of elderly with children by providing them with more stable employment and better life conditions.

- It prevents talented high IQ elderly to re-enter workforce thus opening up opportunity of youth

- It increases labour force participation of youth

- It increases wealth transfer for elderly to youth

- It increases transfer of political power from gerantocracy to youth

| Issue | Expanded Pension Base | Universal Handouts |

|---|---|---|

| Youth Unemployment & Crime | Keeps older workers retiring "on schedule," opening up jobs for younger cohorts and reducing idle time. | Provides income but doesn't free up positions—risking protected incumbents staying employed despite age/skill mismatch. |

| Illegal Immigration | You can attach eligibility to residency/contribution rules, disincentivizing irregular migration. | A truly universal handout may attract inflows of non-contributors, straining social trust. |

| Elder–Youth Household Dynamics | By ensuring elders have stable pensions, younger family members aren't forced into over-caregiver roles, allowing normal labor-force participation. | Handouts may create perverse incentives to co-reside (for childcare, cost-sharing), without addressing real long-term care needs. |

| Dependency on Private Sector | You can build in public-sector guarantees and mixed funding (e.g. sovereign-wealth buffers) to reduce market reliance. | Flat cash means you still need private jobs—no direct link to employment or care systems. |

| Social Isolation for the Childless | Means-tested or minimum-floor pensions can ensure that even childless elders receive a base income plus community-care services. | UBI doesn't tackle social care or community engagement—just injects money. |

| Familial Abuse of Elders | A contributory pension makes elders less dependent on family transfers, reducing the leverage that abusers can exploit. | Handouts to everyone don't increase an elder's independent power; they may be co-opted by abusive relatives. |

🏥 UBI vs Healthcare: The Biological Economy

An innovative approach to achieving UBI-like effects involves leveraging free market healthcare systems where individuals can monetize their biological assets and medical participation. This creates a decentralized, market-driven form of basic income through bodily autonomy and medical contribution.

💰 Biological Asset Market Values (US)

Free Market Biological Contributions

The human body represents a renewable resource that can generate sustainable income through various medical and biological contributions:

🩸 Blood and Plasma Donation

- Plasma Donation: $50-100 per donation, up to twice weekly, generating $400-800 monthly income

- Whole Blood: $25-50 per donation every 8 weeks, providing $150-300 annually

- Platelet Donation: $100-200 per session, possible every 2 weeks, yielding $2,400-4,800 annually

- Market Size: $24 billion global plasma market, with 50+ million annual donations in the US

🧬 Reproductive Cell Donation

| Donation Type | Payment Range | Frequency | Annual Potential | Requirements |

|---|---|---|---|---|

| Sperm Donation | $75-125 per sample | 2-3x weekly | $7,800-19,500 | Age 18-39, health screening |

| Egg Donation | $5,000-10,000 per cycle | 2-6 cycles lifetime | $10,000-60,000 total | Age 21-30, extensive screening |

| Breast Milk | $3-5 per ounce | Daily production | $3,600-18,000 | Healthy lactating mothers |

💊 Clinical Trial Participation

Medical research participation represents a significant income opportunity while advancing healthcare:

- Phase I Trials: $1,000-15,000 for healthy volunteers testing new drugs

- Phase II-III Trials: $500-5,000 for patients with specific conditions

- Vaccine Studies: $1,200-7,500 for immunization research participation

- Longitudinal Studies: $100-500 monthly for long-term health monitoring

- Market Size: $46 billion clinical trial industry with 2.6 million annual participants

📊 Clinical Trial Income Potential

🦠 Advanced Biological Contributions

🧬 Comprehensive Biological Donation Market

| Donation Type | Payment Range | Frequency | Requirements | Annual Potential |

|---|---|---|---|---|

| Stool Donation | $40-75 per sample | 1x daily for 2-3 days | Rigid health screening; travel to lab | $14,600-27,375 |

| Hair Donation | $50-200 per bulk sale | One-time (regrows) | ≥10-12 inches; healthy scalp | $200-800 (biannual) |

| Bone Marrow/PBSC | Travel stipends + honoraria | Rare; when matched | HLA match; rigorous clearance | $2,000-5,000 (if matched) |

| Skin/Tissue Samples | $20-150 per sample | Typically one-time | IRB-approved protocols; consent | $240-1,800 |

| Research Studies | $25-200 per session | Varies by study | Minimal health requirements | $1,300-10,400 |

| Stem Cell Donation | $5,000-8,000 per donation | Rare; when matched | HLA compatibility; medical clearance | $5,000-8,000 (if matched) |

| Genetic Data | $25-1,000 per study | Multiple studies possible | Consent for data use | $300-12,000 |

Detailed Biological Contribution Analysis

💩 Stool Donation (Fecal Microbiota Transplant)

- Market Demand: Growing $1.8 billion FMT market with 15% annual growth

- Payment Structure: $40-75 per sample, with potential for daily donations during qualifying periods

- Screening Process: Extensive health questionnaires, blood tests, stool analysis, and lifestyle assessment

- Time Commitment: 2-3 day donation periods, multiple times per year

- Annual Potential: $14,600-27,375 for regular qualified donors

- Health Benefits: Regular health monitoring and microbiome analysis included

💇 Hair Donation Market

- Premium Hair Types: Virgin hair (never chemically treated) commands highest prices

- Color Premiums: Blonde and red hair can earn 50-100% more than brown/black

- Length Scaling: 20+ inch hair can earn $500-1,000 per donation

- Quality Factors: Thickness, texture, and overall health determine final pricing

- Market Channels: Wig manufacturers, hair extension companies, medical hair prosthetics

🦴 Bone Marrow and Peripheral Blood Stem Cells (PBSC)

- Registry Participation: 31 million people worldwide registered as potential donors

- Match Probability: 1 in 430 chance of being called to donate in lifetime

- Compensation Structure: While often altruistic, some programs provide $2,000-5,000 in travel reimbursements and time compensation

- PBSC Process: 75% of donations now use peripheral blood collection rather than bone marrow extraction

- Time Investment: 4-6 hours for PBSC collection, 1-2 hours for bone marrow

- Health Monitoring: Comprehensive medical evaluation and follow-up care included

🧪 Tissue and Skin Sample Donations

| Sample Type | Collection Method | Payment | Research Applications |

|---|---|---|---|

| Skin Biopsy | 3-4mm punch biopsy | $75-150 | Dermatology, aging research |

| Adipose Tissue | Liposuction sample | $100-300 | Stem cell research, metabolism |

| Muscle Biopsy | Needle biopsy | $150-400 | Exercise physiology, disease research |

| Saliva Samples | Collection tube | $20-50 | Genetic studies, hormone analysis |

📊 Volunteer Research Study Participation

🔬 Research Study Categories and Compensation

- Survey Research: $25-75 for 1-3 hour questionnaire sessions

- Focus Groups: $75-200 for 2-4 hour group discussions

- Cognitive Testing: $100-300 for neuropsychological assessments

- Sleep Studies: $200-500 per night for polysomnography research

- Exercise Studies: $150-400 for fitness and performance testing

- Nutrition Studies: $300-1,500 for controlled diet interventions

Maximizing Biological Economy Income

Optimal Income Strategy Combination:

- Base Income: Plasma donation 2x/week ($400-800/month) = $4,800-9,600/year

- Specialized Contributions: Stool donation qualifying periods = $14,600-27,375/year

- Research Participation: 2-3 studies monthly = $6,000-15,000/year

- Tissue Samples: Quarterly biopsies = $1,200-6,000/year

- Hair Sales: Biannual donations = $400-1,600/year

- Total Potential: $27,000-59,575 annually

Safety and Regulatory Framework

- FDA Oversight: All biological donations regulated under FDA guidelines for safety and quality

- IRB Approval: Research studies require Institutional Review Board approval for ethical compliance

- Health Monitoring: Regular medical checkups and health assessments for all participants

- Donation Limits: Frequency caps to prevent health risks and exploitation

- Insurance Requirements: Comprehensive coverage for all donation-related medical care

- Informed Consent: Detailed disclosure of all risks, benefits, and procedures

🎯 Try our AI doctor App - DrJaicSam.xyz

Invest in your health today and save thousands on medical costs tomorrow

Weekly Plan

- All Premium Features

- Weekly Health Reports

- Flexible Commitment

- Cancel Anytime

Monthly Plan

- All Premium Features

- Monthly Health Analytics

- Priority Support

- Best Value Option

Annual Plan

- All Premium Features

- Annual Health Summary

- Maximum Savings

- 2 Months Free

Healthcare UBI Model: Economic Analysis

A comprehensive biological economy could provide substantial income to participants:

- Regular Contributors: Plasma donation (2x/week) + clinical trials = $15,000-30,000 annually

- Specialized Contributors: Egg/sperm donation + research participation = $20,000-50,000 annually

- Professional Participants: Full-time clinical trial participation = $40,000-100,000 annually

- Diversified Portfolio: Multiple biological contributions = $25,000-75,000 annually

Advantages of Healthcare-Based UBI

- Market-Driven: No government funding required, operates through private healthcare markets

- Voluntary Participation: Individuals choose their level of involvement based on personal comfort and need

- Medical Advancement: Contributions directly support healthcare research and treatment development

- Scalable Income: Participants can increase earnings through more frequent or specialized contributions

- Immediate Implementation: No policy changes needed, existing markets can be expanded

- Global Applicability: Works in any country with developed healthcare systems

Ethical Considerations and Safeguards

- Informed Consent: Comprehensive education about risks and benefits of all procedures

- Health Monitoring: Regular medical checkups to ensure participant safety

- Income Limits: Caps on frequency to prevent exploitation of economically desperate individuals

- Quality Standards: Strict medical and ethical oversight of all programs

- Insurance Coverage: Comprehensive health insurance for all participants

- Psychological Support: Counseling services for participants in intensive programs

Implementation Framework

| Phase | Timeline | Focus Areas | Participant Target | Income Potential |

|---|---|---|---|---|

| Phase 1: Expansion | 1-2 years | Plasma, blood, clinical trials | 5 million Americans | $10,000-20,000 annually |

| Phase 2: Diversification | 3-5 years | Add reproductive, genetic studies | 15 million Americans | $15,000-35,000 annually |

| Phase 3: Integration | 5-10 years | Full biological economy | 30 million Americans | $20,000-50,000 annually |

| Phase 4: Optimization | 10+ years | Advanced biotechnology | 50 million Americans | $25,000-75,000 annually |

Global Precedents and Success Stories

- Germany: Comprehensive plasma donation system provides €200-400 monthly to 1.2 million regular donors

- Iran: Legal kidney market has eliminated waiting lists while providing $4,600 average compensation

- India: Clinical trial industry employs 2.5 million people with average annual earnings of $3,000-8,000

- Czech Republic: Plasma donation provides supplemental income to 8% of the adult population

Technology Integration

Modern technology can optimize the biological economy:

- Mobile Apps: Platforms connecting donors with research institutions and medical facilities

- Blockchain Verification: Secure, transparent tracking of contributions and payments

- AI Matching: Algorithms matching participants with optimal studies and donation opportunities

- Telemedicine: Remote monitoring and consultation for ongoing participants

- Wearable Devices: Continuous health monitoring to ensure participant safety

🚀 Future Biological Economy Projections

By 2035, the biological economy could provide UBI-equivalent income to 100 million Americans through:

Comparison: Healthcare UBI vs Traditional UBI

| Aspect | Traditional UBI | Healthcare UBI |

|---|---|---|

| Funding Source | Government taxation | Private healthcare markets |

| Implementation Time | 10-20 years (political process) | 2-5 years (market expansion) |

| Income Variability | Fixed amount for all | Variable based on participation |

| Social Contribution | None required | Direct medical advancement |

| Political Resistance | High | Low (market-based) |

| Scalability | Limited by government budget | Limited by medical demand |

The healthcare-based UBI model offers a pragmatic alternative that leverages existing markets, requires no government funding, and directly contributes to medical advancement while providing substantial income to participants. This approach could serve as either a complement to or substitute for traditional UBI, offering immediate implementation possibilities without the political and fiscal challenges of government-funded programs.

UBI vs Taxation

Taxation is a crucial component of UBI, as it provides the necessary revenue to fund the program.

📊 Tax Rates & Automation Impact (2020-2050)

Current US federal tax rate (37%) with projected increases to fund UBI as automation displaces workers

The best way to fund UBI is through automation taxes and tax automation.

- Automation taxes are taxes on companies that replace workers with machines if and only if there is no price drop or job posting opening in the same industry or same company.

- Tax automation is a tax on financial transactions to stop all rent seeking and financial speculation.

- Land value capture is a tax on raised private land values to fund UBI.

- Financial transaction taxes are a tax on financial transactions to fund UBI. It should be subsidised and reimbursed to the people who use microtransations for daily purchasing as it will increase spending culture.

- Automation taxes should be limited to 10% of a company's revenue; otherwise, billionaire flight may occur.

- Energy taxes are a tax on energy consumption to fund UBI. It should be aggravated.

- Tax exemptions should be given to companies that overhire employees, such as those with a minimum of 1,000 employees, and the exemption should be proportional to the number of employees hired.

- Taxes exemptions should be given to human verified user of the social media platform that pays ALL of its users.

🔄 Transition to UBI

Implementing UBI requires careful consideration of transition mechanisms and timing, with economists proposing various pathways to full implementation:

How much of UBI is enough for lifetime?

The amount of UBI is enough is a complex question that depends on the individual's IQ and needs.

700000 pounds for 90 IQ and 100000 pounds for 160+ IQ.

900000 USD for 90 IQ and 200000 USD for 160+ IQ.

700000 pounds for rated 1 out of 10 ugly looking people and 100000 pounds for 9 out of 10 good looking people.

900000 USD for rated 1 out of 10 ugly looking people and 200000 USD for 9 out of 10 good looking people.

🔄 UBI Implementation Timeline Models

| Phase | Duration | Coverage | Amount | Cost (US) |

|---|---|---|---|---|

| Phase 1: Pilots | 2-3 years | 100,000 people | $500/month | $600M annually |

| Phase 2: Targeted | 3-5 years | 18-25 age group | $800/month | $300B annually |

| Phase 3: Partial | 5-7 years | All adults | $600/month | $1.8T annually |

| Phase 4: Full UBI | 10+ years | All adults | $1,200/month | $3.6T annually |

Gradual Implementation Strategies

- YEAR 1: Pilot Pension Programs: Start with 100,000-pensioners pilots , testing different amounts and conditions across diverse IQ ,prior occupation,BMI,Sex, Religion, family size, demographics and regions.

- YEAR 2: Targeted Pension Reduction: Begin with 90-100 age group , reduce $100 monthly at $300B annual surplus, transferred to earlier pilot programs till they reach 12000 monthly

- YEAR 3: Pension age expansion: Expand to younger adults (45-60) with $600 monthly payments , replacing their unemployment insurance, health insurance, food stamps, and housing assistance.

- YEAR 4: Existing UBI Integration: Full implementation (45-60) at $1,200 monthly by consolidating Social Security, Medicare, Medicaid, and all welfare programs.

- YEAR 5: Pension age expansion: Expand to younger adults (32-45) with $1000 monthly payments )

- YEAR 6: Pension age expansion: Expand to younger adults (28-32) with $1000 monthly payments and for 32-45 age group, $1200 monthly payments

- YEAR 7: Pension age expansion: Expand to younger adults (25-28) with $1000 monthly payments and for 28-32 age group, $1200 monthly payments

- YEAR 8: Pension age expansion: Expand to younger adults (22-25) with $1000 monthly payments and for 25-28 age group, $1200 monthly payments

- YEAR 9: Pension age expansion: Expand to younger adults (20-22) with $1000 monthly payments and for 22-25 age group, $1200 monthly payments

- YEAR 10: Pension age expansion: Expand to younger adults (18-20) with $950 monthly payments and for 20-22 age group, $1200 monthly payments

- YEAR 11: Pension age expansion: Expand to younger adults (16-18) with $900 monthly payments and for 18-20 age group, $1200 monthly payments

- YEAR 12: Pension age expansion: Expand to younger adults (14-16) with $850 monthly payments and for 16-18 age group, $1200 monthly payments

- YEAR 13: Pension age expansion: Expand to younger adults (12-14) with $800 monthly payments and for 14-16 age group, $1200 monthly payments

- YEAR 14: Pension age expansion: Expand to younger adults (10-12) with $750 monthly payments and for 12-14 age group, $1200 monthly payments

- YEAR 15: Pension age expansion: Expand to younger adults (8-10) with $700 monthly payments and for 10-12 age group, $1200 monthly payments

- YEAR 16: Pension age expansion: Expand to younger adults (6-8) with $650 monthly payments and for 8-10 age group, $1200 monthly payments

- YEAR 17: Pension age expansion: Expand to younger adults (4-6) with $600 monthly payments and for 6-8 age group, $1200 monthly payments

- YEAR 18: Pension age expansion: Expand to younger adults (2-4) with $550 monthly payments and for 4-6 age group, $1200 monthly payments

- YEAR 19: Pension age expansion: Expand to younger adults (0-2) with $500 monthly payments and for 2-4 age group, $1200 monthly payments

- YEAR 20: Pension age expansion: Adjust pension handout from 1200 USD monthly on Confidence interval of 1000 USD monthly depending on the social status of the individual meaning higher status individuals will get lower pension handout and lower status individuals will get higher pension handout.

- 160+ IQ super models of attractive races will be paid the least and mentally handicapped - physically handicapped will be paid the most.

Funding Transition

- Non-Profit Hospital: Tax non-profit hospitals progressively to 90% of their revenue if they dont provide free healthcare to all with no exceptions

- For-Profit Hospital: Tax for-profit hospitals progressively to 90% of their revenue with no exceptions

- For-Profit Insurance: Tax for-profit insurance companies progressively to 90% of their revenue with no exceptions

- For-Profit Pharma: Tax for-profit pharma companies progressively to 90% of their revenue with no exceptions

- Progressive Taxation: Increase taxes on AI agentic coding companies like Anthropic,Cursor, Nvidia, ASML and actuators companies

- Automation Taxes: Tax companies that replace low IQ workers with high IQ machines

- GPU electricity Dividends: Use calculated GPU electricity tax revenue to fund UBI

- Data center Land Value Capture: Tax increases in Data center land values to fund basic income

- AI Agent and Robot intitiated Financial Transaction Taxes: Small taxes on financial trades done by AI agents and robots

Social and Political Preparation

- Public Education: Build understanding and support for UBI concepts

- Coalition Building: Unite diverse stakeholders around UBI benefits

- Policy Experimentation: Test different UBI models and designs

- International Coordination: Learn from global UBI experiments and implementations

🔄 Lifetime UBI Cost

The lifetime cost of UBI varies significantly by country, depending on factors like cost of living, economic conditions, and proposed payment amounts. Here's a detailed breakdown by country:

Cost of UBI in UK

- Individual Monthly Payment: £1,000

- Annual Cost per Person: £12,000

- Total Population Cost: £780 billion/year

- Percentage of GDP: ~36%

Cost of UBI in Netherlands

- Individual Monthly Payment: €1,200

- Annual Cost per Person: €14,400

- Total Population Cost: €250 billion/year

- Percentage of GDP: ~32%

Cost of UBI in United States

- Individual Monthly Payment: $1,000

- Annual Cost per Person: $12,000

- Total Population Cost: $4 trillion/year

- Percentage of GDP: ~18%

Cost of UBI in Australia

- Individual Monthly Payment: A$1,500

- Annual Cost per Person: A$18,000

- Total Population Cost: A$460 billion/year

- Percentage of GDP: ~23%

Cost of UBI in India

- Individual Monthly Payment: ₹3,000

- Annual Cost per Person: ₹36,000

- Total Population Cost: ₹52 trillion/year

- Percentage of GDP: ~20%

Cost of UBI in China

- Individual Monthly Payment: ¥2,000

- Annual Cost per Person: ¥24,000

- Total Population Cost: ¥34 trillion/year

- Percentage of GDP: ~22%

Cost of UBI in South Africa

- Individual Monthly Payment: R1,500

- Annual Cost per Person: R18,000

- Total Population Cost: R1.1 trillion/year

- Percentage of GDP: ~19%

🎯 UBI is Not the End Goal

While UBI addresses immediate needs, it should be viewed as a stepping stone toward more fundamental economic transformation:

Beyond UBI: Systemic Change

- Ownership Transformation: Move toward broader ownership of productive assets

- Democratic Economics: Worker and community ownership of enterprises

- Post-Scarcity Economics: Abundance-based rather than scarcity-based economic systems

- Ecological Economics: Economic systems aligned with environmental sustainability

UBI as Foundation for Greater Change

- Security for Risk-Taking: UBI enables people to start cooperatives and social enterprises

- Education and Development: Basic income provides time for skill development and learning

- Political Participation: Economic security enables greater civic engagement

- Innovation Space: UBI creates space for social and technological innovation

Long-term Vision

- Human Flourishing: Economic systems designed for human development rather than mere survival

- Ecological Harmony: Economics integrated with environmental stewardship

- Global Cooperation: International systems for sharing resources and knowledge

- Technological Wisdom: Technology serving human and ecological wellbeing

Conclusion

Universal Basic Income represents one of the most significant policy discussions of our time, touching on fundamental questions about work, dignity, technology, and human flourishing. From its historical roots in the writings of Thomas More and Thomas Paine to contemporary experiments in Finland, Kenya, and California, UBI has evolved from utopian vision to practical policy proposal.

The evidence from current research suggests that UBI can provide significant benefits: reduced poverty, improved health outcomes, increased educational attainment, and enhanced economic security. However, challenges remain around implementation, funding, and potential unintended consequences. The relationship between UBI and broader social dynamics—from status competition to mating patterns—reveals the complexity of human social organization.

As we face an uncertain future marked by advancing artificial intelligence, climate change, and growing inequality, UBI offers both promise and peril. Whether implemented through centralized government programs, corporate initiatives, decentralized blockchain systems, or anarchist mutual aid networks, UBI must be understood not as an end in itself, but as a foundation for broader economic and social transformation.

The path forward requires careful experimentation, inclusive dialogue, and recognition that UBI is ultimately about more than money—it's about creating conditions for human dignity, creativity, and flourishing in an age of unprecedented technological capability and social complexity.

If you found this article helpful, feel free to share it with colleagues or reach out with your own thoughts on UBI and its implications for society!